Dynamics 365 CRM for Insurance Brokers

Jun 14, 2024 Aiswarya Madhu

Editor's Note

Did you know that over 50% of insurance customers now expect 24/7 support from agents? Meeting these rising expectations is no small feat. That's why we’ve put together this article to show how Dynamics 365 CRM for Insurance Brokers can help you stay ahead. From streamlining operations to automating workflows and delivering personalized member experiences, this guide dives into how Dynamics 365 can transform your insurance operations and ensure you're ready to meet your customers’ needs, anytime, anywhere.

The healthcare industry, comprising nearly 18% of the US GDP and 11% of employment, has been slow to adopt digital innovation. As technology advances, insurance companies and payors are discovering new ways to improve efficiency and customer satisfaction.

In a world where life insurance serves as a helping hand, ready to support individuals when life throws a curveball, it's essential for insurance brokers to leverage modern technology to provide seamless and effective services.

Dynamics 365 CRM for insurance brokers offers a comprehensive platform to streamline operations, enhance workflows, and deliver personalized services.

Here’s a comprehensive guide on how Dynamics 365, one of the leading health insurance CRMs, helps payors automate claims processing, ensure compliance, and enhance care coordination.

On this page

What is Dynamics 365 CRM For Insurance Brokers?

Dynamics 365 CRM for Insurance Brokers is a comprehensive CRM solution designed to streamline operations and enhance customer relationship management across the insurance industry, including healthcare payors

It includes pre-built features and best practices tailored to the insurance industry which helps to centralize data, automate claims and policy management, and offers advanced analytics, ensuring regulatory compliance and improving overall efficiency.

This empowers payors to deliver better member experiences and achieve optimal financial outcomes.

Here’s what it covers:

- Customer Experience: Personalize interactions using AI-driven insights, provide omnichannel support, and utilize predictive analytics to anticipate customer needs.

- Compliance: Maintain detailed records of underwriting decisions, automate compliance checks, and simplify regulatory reporting with comprehensive audit trails.

- Business Processes: Automate and integrate campaign management, event management, lead management, sales pipeline management, and policy management to improve efficiency and reduce manual errors.

- Data Management: Consolidate data from various sources into a single platform, use advanced analytics to uncover actionable insights, and create customizable reports and dashboards.

- Communication: Enhance omnichannel engagement, implement AI-powered self-service portals, and facilitate real-time customer interactions to improve service quality.

- Operational Efficiency: Equip employees with productivity tools such as task automation and workflow management, provide easy access to essential data, and monitor performance to identify areas for improvement.

- Collaboration: Foster cross-department collaboration with a unified platform, integrated communication tools, and seamless resource sharing to improve coordination and efficiency.

- Insurance Accelerator: Utilize pre-built data models and applications for quick deployment of health insurance-specific solutions, including Power BI dashboards for insights on policies, claims, and upcoming appointments, as well as streamlined customer onboarding and policy management.

Unlock the potential of Microsoft Dynamics CRM for Healthcare. Read the blog for a complete guide and discover innovative solutions.

Additional Insights

What is Microsoft Cloud for Healthcare?

Microsoft Cloud for Healthcare is a specialized platform designed to address the complex needs of the healthcare industry, including payors. It offers a suite of integrated solutions that enhance operational efficiency, improve patient care, and facilitate data-driven decision-making through advanced technologies such as AI, data analytics, and seamless collaboration tools.

Key Solutions in Microsoft Cloud for Healthcare:

- Unified Member View: Centralizes member data, providing insights into claims, coverage, risk profiles, and care plans.

- Care Journey Templates: Automates workflows for common care scenarios, improving care management and coordination.

- Remote Care Management: Supports remote patient monitoring and health data analysis to enhance hybrid care services.

- Virtual Health Data Tables: Manages FHIR data with real-time updates, ensuring accurate and compliant data handling.

- Text Analytics for Health: Extracts insights from unstructured biomedical data, including social determinants of health.

- Project Health Insights: Provides AI-driven decision support for clinical trial matching and identifying cancer attributes.

- Azure Health Bot: Enhances patient interaction through AI-driven virtual health assistant capabilities.

- Responsible AI Dashboard: Ensures fairness, explainability, and bias checking in AI models used in healthcare settings.

How It Could Be Used with Dynamics 365

Leveraging the combined power of Microsoft Cloud for Healthcare and Dynamics 365 enhances CRM capabilities for insurance companies. Unified member views and automated workflows from the Cloud can be combined with Dynamics 365's sales and customer service tools to provide a seamless, efficient, and personalized experience for both members and healthcare providers. This combination empowers payors to improve operational efficiency, drive better health outcomes, and deliver exceptional member experiences.

Navigating Health Insurance Industry Challenges in 2024

In 2024, the insurance industry faces a multitude of challenges stemming from demographic shifts, regulatory changes, and evolving member preferences. Insurance companies must adapt to these changes to remain competitive and efficient. Here’s an overview of the key challenges and considerations for insurers this year.

Managing Financial Pressures and Cost Containment

Insurance companies are under sustained economic pressures with rising utilization rates impacting financial outcomes. The imperative to contain costs is stronger than ever. Without an advanced system, it becomes challenging to optimize medical costs, administrative expenses, and product designs. Companies lacking in data analytics capabilities struggle to identify cost-saving opportunities and improve operational efficiency. Moreover, without integrated value-based care models, it becomes difficult to coordinate care effectively, leading to higher unnecessary expenditures.

Adapting to Demographic Shifts

The aging population presents significant challenges for insurers, particularly in managing eldercare and addressing workforce shortages. Nearly half of the eligible population will be aged 75 or older by 2030.

Without a proper system to manage and analyze patient data, insurers cannot offer personalized care plans effectively. The absence of tools for remote monitoring and telehealth integration means missed opportunities for meeting the needs of this higher-need population.

Additionally, without integrated workforce management solutions, it’s difficult to allocate healthcare professionals efficiently to meet the growing demands.

Enhancing Star Ratings and Regulatory Compliance

Changes in regulatory requirements and performance metrics, such as Star ratings, require continuous adaptation from insurance companies. Companies without an automated system for compliance management risk falling behind regulatory changes, leading to potential penalties and reduced ratings. Additionally, the inability to enhance member and provider engagement through omnichannel outreach impacts Star ratings negatively, as insurers fail to focus on member satisfaction and health outcomes.

Leveraging Special Needs Plans (SNPs) Opportunities

Special Needs Plans (SNPs), driven by both demographic and regulatory trends, represent an area of increased focus for insurers. Without a sophisticated system, insurers struggle to conduct targeted outreach to dual-eligible and chronic-condition populations, missing growth opportunities.

The lack of integration with Medicaid management systems complicates processes and reduces the efficiency of service delivery for SNPs, hindering the ability to tap into this emerging market effectively.

Navigating Broker Channel Constraints

Insurance companies rely heavily on broker channels for efficient and high-volume sales capabilities. Recent regulatory changes propose caps on broker compensation, impacting the financial viability of field-marketing organizations and brokerages.

Without robust broker management tools, insurers find it challenging to maintain competitiveness and ensure compliance with new regulations. The absence of streamlined broker interactions and sales processes further hinders their ability to navigate these constraints effectively.

Digital Transformation of Legacy Systems

Many healthcare insurance companies rely on outdated legacy systems that are not compatible with modern technologies.

This creates difficulties in implementing new, efficient processes and integrating advanced digital solutions.

Modernizing these systems is crucial but often involves significant time, cost, and resource investment.

Interoperability and Data Integration

The lack of seamless data exchange between different health systems and insurers is a major barrier. Interoperability issues lead to fragmented care, data silos, and inefficient coordination between providers and insurers. Consistent data standards and integration protocols are necessary to improve care coordination and patient outcomes.

Data Security and Privacy Concerns

Protecting sensitive patient information from cyber threats is a critical challenge. Healthcare data is a prime target for hackers, and any breach can result in severe legal and financial repercussions. Ensuring compliance with stringent data privacy regulations, such as HIPAA, adds to the complexity.

Managing Data Explosion and Dispersion

The healthcare industry generates vast amounts of data from various sources, including electronic medical records (EMR), clinical data, and insurance claims. Integrating and managing this dispersed data effectively is challenging but essential for making informed decisions and improving patient care.

Automating Claims Processing and Fraud Detection

Manual claims processing is time-consuming and prone to errors. Additionally, detecting and preventing fraud requires sophisticated verification mechanisms. Automation and advanced analytics are necessary to streamline claims processing and enhance fraud detection capabilities.

Enhancing Patient and Provider Communication

Effective communication between patients, providers, and insurers is often hindered by manual processes and fragmented systems. Developing efficient digital communication channels can reduce administrative burdens, prevent miscommunications, and improve overall care coordination.

Implementing Virtual-First Health Plans

Virtual-first health plans prioritize digital solutions for patient engagement, such as telehealth visits, e-triage, and e-prescribing. Implementing these plans effectively requires ensuring that digital health tools are user-friendly, accessible, and integrated into the broader healthcare system.

Standardizing Integrated Health Records

Creating standardized, member-accessible integrated health records that compile comprehensive patient data and provide near real-time updates is crucial. Inconsistent data formats and lack of standardization can impede the effectiveness of these records, limiting their utility for patients and providers alike.

Enterprise-wide Collaboration

Many payors struggle with siloed operations, where different departments work in isolation. Successful digital transformation requires breaking down these silos to deliver a seamless member experience across all touchpoints.

Internal Orientation

Payors often focus on internal processes rather than the member’s perspective. A shift to a human-centered design approach is necessary to create better member experiences.

A Health Care Giant Under Siege: The Story Behind the Cyberattack

In February 2024, the U.S. health insurance billing system faced an unprecedented crisis when a cyberattack hit Change Healthcare, a subsidiary of UnitedHealthGroup. This attack, which the American Hospital Association called the most significant in U.S. healthcare history, forced Change Healthcare to take its electronic payments and insurance claims systems offline, disrupting services for millions.

The Immediate Impact

The attack stopped billions of dollars from flowing to healthcare providers. Small clinics, especially in rural areas, were hit hard, struggling to stay afloat without the ability to process claims or receive payments. Patients were affected too, with some having to pay out of pocket for vital medications.

A Gradual Recovery

By mid-March, Change Healthcare had restored most of its services, processing 95% of health insurance claims. However, the financial impact on small clinics and rural providers remained a concern, and efforts were ongoing to ensure their stability.

How a Health Insurance CRM Could Help in Such Situations

In situations like this, having a comprehensive CRM solution for insurance, like Dynamics 365 for Insurance, could be invaluable. Such a platform offers several features that can help healthcare providers manage crises more effectively:

- Enhanced Communication: A CRM enables efficient communication with patients, insurers, and stakeholders, ensuring everyone is informed about the status of claims and available support.

- Data Management: The platform can securely store and manage patient records, ensuring that critical information is always accessible even during system outages.

- Financial Tracking: With integrated financial management tools, clinics can monitor cash flow, track outstanding claims, and manage billing issues, helping to maintain financial stability.

- Customer Service: A CRM provides robust customer service capabilities, allowing healthcare providers to address patient concerns promptly and manage queries related to billing and insurance claims efficiently.

Looking to transform your healthcare insurance operations?

Microsoft Dynamics CRM for Insurance offers the tools to streamline processes, enhance customer experiences, and ensure compliance. Let Nalashaa Digital craft a tailored solution for your unique needs.

Dynamics 365 for Insurance Capabilities

Dynamics 365 for insurance brokers offers a range of features and capabilities that can benefit payors in the healthcare industry. Some key ways Dynamics 365 can help payors include:

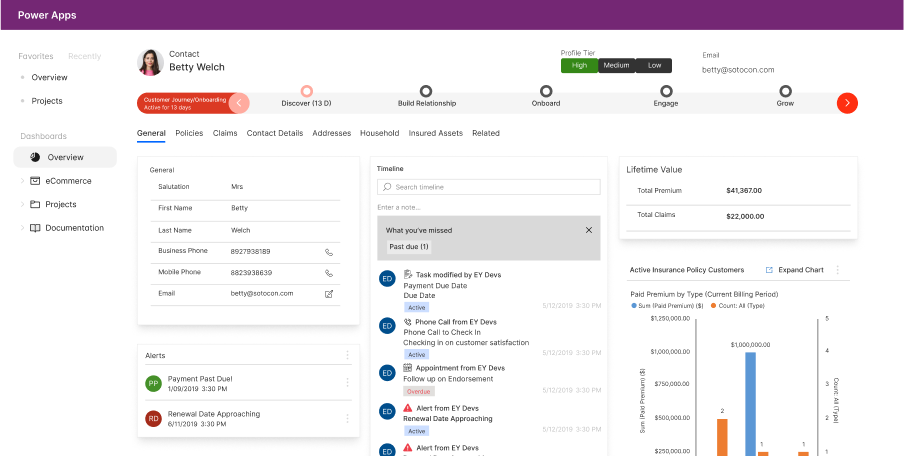

Member Management

The platform can help payors manage member information, including enrollment, eligibility, and benefits. It can streamline processes related to member onboarding, changes in coverage, and member communications.

Here’s a detailed account of member management that you can do using Dynamics 365 CRM for Insurance brokers:

- Strong Automated Enrollment Processing: With Dynamics 365, payors can streamline the enrollment process for new members. The system automatically generates enrollment records based on predefined criteria, such as plan type and eligibility, reducing the need for manual data entry.

- Strong Effortless Eligibility Verification: Dynamics 365 automates eligibility verification, checking member eligibility based on rules like age and employment status. This automation speeds up the process and ensures accurate benefits determination without manual intervention.

- Strong Seamless Benefit Updates: Benefit management becomes automated with Dynamics 365. The system updates member benefits according to predefined rules, such as changes in coverage or new dependents, ensuring members receive accurate and timely information.

- Strong Simplified Member Onboarding: Dynamics 365 automates member onboarding by generating welcome materials like letters and ID cards for new members. This streamlines the process and ensures new members have all the necessary information.

- Strong Personalized Member Communications: The platform automates personalized member communications, sending reminders for appointments, notifications about benefit changes, and information on wellness programs. This automation keeps members informed and engaged without manual efforts.

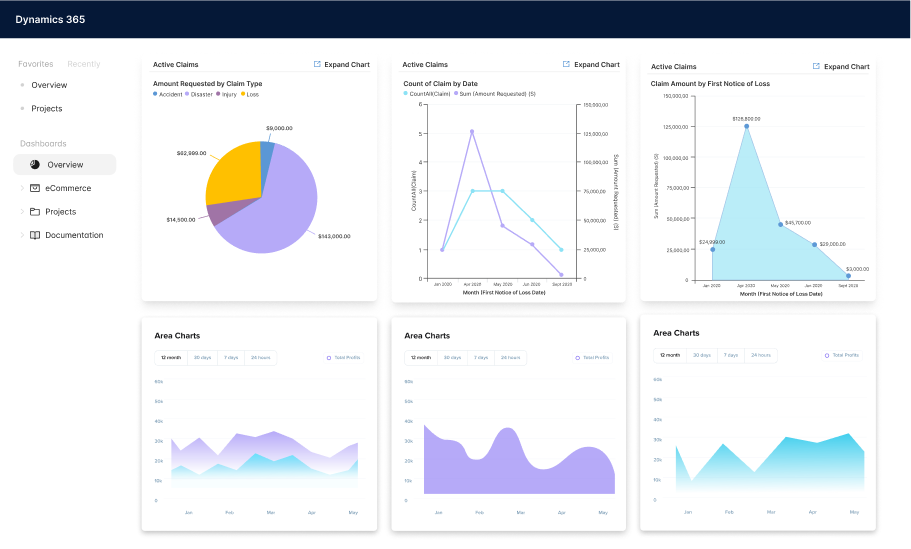

Claims Processing

Dynamics 365 can streamline claims processing workflows, making it easier for payors to manage and process claims efficiently. It can help automate claim submissions, adjudication, and payments, reducing manual errors and improving accuracy.

- Strong Claim Submission Automation: Traditionally, claims are submitted via paper forms, which are then manually entered into the system. Using Dynamics 365, claims can be submitted electronically through a member portal or directly from a healthcare provider's system. This eliminates the need for manual data entry and reduces the chances of errors.

- Strong Claim Validation Automation: In traditional setups, claims are manually reviewed for completeness and accuracy, which can be time-consuming and prone to errors. Dynamics 365 can automatically validate claims based on predefined rules. For example, it can check if the patient is eligible for the service, if the service is covered under the policy, and if the claim is filed within the allowed time frame.

- Strong Adjudication Automation: Adjudicating claims involves complex calculations based on various factors such as contract terms, fee schedules, and medical policies. Dynamics 365 can automate the adjudication process using algorithms that calculate the payment amount based on the predefined rules and criteria. This ensures consistent and accurate payment calculations.

- Strong Payment Processing Automation: In a manual payment processing setup, staff must manually review and approve each claim, calculate the payment amount, and then issue payments either by preparing checks or processing electronic transfers. Dynamics 365 for insurance simplifies payment processing by automating the generation of payment instructions for approved claims. It directly integrates with banking systems for electronic funds transfers (EFTs) and automatically generates checks for physical payments. This reduces manual effort, minimizes errors, and speeds up the entire payment process.

- Strong Denial Management Automation: In the manual process of payment processing for denials, staff members must individually review each denied claim to understand the reasons for denial. They verify the accuracy of the information, check compliance with policy rules, and determine whether the denial is justified. Dynamics 365 automates denial management by using rule-based workflows that immediately identify and categorize denials based on specific criteria, such as the reason for denial or the claim value. Once categorized, the system automatically routes these denials to the appropriate staff or department for review. This ensures that each denial is handled by the most qualified personnel, speeding up the resolution process. Additionally, Dynamics 365 uses its data analytics capabilities to analyze patterns and trends in denials, providing actionable insights.

Provider Network Management

Dynamics 365 can help payors manage their provider networks more effectively. It can assist in provider contracting, credentialing, and network optimization, ensuring that payors have access to high-quality providers for their members.

- Strong Provider Onboarding and Contracting: As new providers apply to join the network, Dynamics 365 automatically verifies their credentials against integrated databases, flagging any discrepancies for review. The system manages digital contracts, enabling payors to create, send, and track contracts within a unified platform. Automated reminders and status updates ensure contracts are signed and returned on time, reducing manual input and speeding up the onboarding process.

- Strong Credentialing Process: Dynamics 365 integrates with various credentialing databases (Council for Affordable Quality Healthcare (CAQH), Drug Enforcement Administration (DEA)) to pull in necessary documentation and verify provider qualifications automatically. It also tracks the expiration dates of provider credentials, sending alerts for renewals to ensure continuous compliance without manual monitoring.

- Strong Network Optimization: Dynamics 365 aids payors in optimizing their provider networks by analyzing key metrics such as patient satisfaction and cost efficiency. It assesses the geographical distribution of providers, identifying areas with insufficient coverage to guide targeted recruitment. This enables payors to strategically expand their network where needed, ensuring members have access to quality care. Dynamics 365 also integrates with various data systems, enhancing network management through real-time performance reports and strategic decision-making. This streamlined approach helps maintain a high-quality provider network that effectively meets the healthcare needs of members while managing costs.

- Strong Ongoing Provider Relationship Management: Using Dynamics 365, healthcare payors can significantly enhance provider relationship management and claims processing. Automated email campaigns ensure consistent communication of policy updates, while the portal allows providers to easily submit feedback, improving satisfaction and network management.

- Strong Claims processing within the Provider Network: Providers submit claims directly through the Dynamics 365 portal. The system checks claims for errors and omissions automatically and allows both providers and payors to track the status of claims in real-time, with automated notifications for approvals, denials, or requests for more information.

- Strong Compliance and Reporting: Dynamics 365 monitors transactions and interactions with providers against compliance standards, automatically flagging issues. The system also provides robust reporting tools that generate detailed reports on various aspects of provider management, aiding in transparency and strategic decision-making.

Care Management

Dynamics 365 CRM for insurance brokers can support payors in managing care coordination and population health initiatives. It can help payors identify at-risk members, manage care plans, and track outcomes, improving the overall health of their member population.

- Strong Identifying At-Risk Members: By integrating data from various sources like medical and pharmacy claims, lab results, and healthcare utilization, Dynamics 365 uses advanced analytics and machine learning to identify members at high risk of chronic conditions or needing immediate care. This system automates the generation of alerts to care managers, streamlining the identification process without extensive manual review.

- Strong Managing Care Plans: After identifying at-risk individuals, the platform facilitates the creation of personalized care plans. It leverages insights from member-specific data to suggest effective interventions and automates the distribution of tasks to the appropriate healthcare providers. This ensures efficient coordination and delivery of care tailored to individual needs.

- Strong Monitoring and Adjustment: Real-time updates from healthcare providers allow the system to dynamically adjust care plans based on new health information. Continuous monitoring and adjustments ensure that care strategies remain relevant and are responsive to the evolving needs of members. Performance metrics are tracked via intuitive dashboards, assessing the impact of interventions.

- Strong Reporting and Analytics: Comprehensive analytics tools within Dynamics 365 provide detailed reports on the effectiveness of care strategies, crucial for both regulatory compliance and internal evaluations. Predictive analytics also play a role by forecasting future trends, helping payors proactively adapt their healthcare strategies to meet anticipated needs.

Get insights on how you can empower patients and providers with self-service web portals in healthcare. Read more on our blog.

How Microsoft Helped Healthcare Payors Transform Data Management

Humana, a leading health insurance company, partnered with Microsoft to consolidate 47 disparate data sources and BI tools using Power BI and Azure solutions, significantly benefiting healthcare payors.

- Unified Data Management: Integrated data sources into Azure Data Lake Storage, providing a cohesive platform for payors to access and analyze member information.

- Enhanced Insights: Created real-time dashboards with Power BI, enabling payors to track social determinants of health and make data-driven decisions.

- Operational Efficiency: Improved data visualization and reduced load times, streamlining payors' workflows.

- COVID-19 Response: Facilitated rapid data analysis and strategy formulation, ensuring payors could adapt swiftly during the pandemic.

Where Health Insurance Brokers Need to Put Their Focus in 2024 & Beyond

Addressing High Uninsured Rates

Strong Regional Focus: The South has the highest rates of uninsured individuals. States like Mississippi (14.4%), Texas (13.0%), Oklahoma (12.4%), and Georgia (12.0%) have significant portions of their populations without health insurance.

Dynamics 365 can help insurance payors identify regions with high uninsured rates using its geographic data analysis capabilities. By integrating data from various sources, Dynamics 365 can visualize and map uninsured populations, allowing payors to pinpoint specific areas for targeted outreach programs. This enables payors to allocate resources effectively and tailor their marketing efforts to regions with the highest need.

Enhancing Affordability and Accessibility

Strong Affordability Initiatives: Cost remains a major barrier to obtaining health insurance, with 64% of uninsured nonelderly adults citing high costs as the primary reason for lack of coverage.

Healthcare CRMs like Dynamics 365 enable the management of subsidy programs and cost-sharing reductions by automating eligibility verification and subsidy allocation processes, making insurance more affordable for low-income individuals.

Strong Expanding Medicaid: Many Southern states have not expanded their Medicaid programs, contributing to lower insured rates. Advocacy for Medicaid expansion in these regions can help increase coverage.

Dynamics 365 can streamline the enrollment process for Medicaid by automating application processing and tracking, thereby facilitating easier access for eligible individuals.

Tailored Plans for Diverse Demographics

Youth Focus: Younger adults (ages 18-24) have the highest uninsured rates at more than 30%. Payers can design affordable, attractive insurance plans tailored to the needs and financial situations of younger demographics.

Healthcare CRM technology can segment younger demographics based on their unique needs and preferences, allowing payors to design and market customized insurance plans effectively.

Strong Racial Disparities: Hispanic (18.0%) and Black (around 11%) Americans have higher uninsured rates compared to White (5.4%) and Asian (6.0%) Americans. Culturally sensitive marketing and outreach programs can help bridge these gaps.

CRM for healthcare can track demographic data and customer interactions to create culturally sensitive marketing campaigns and outreach efforts, increasing engagement and insurance uptake in these communities.

Strong Income-Based Plans: Individuals with lower incomes (below $25,000 per year) have uninsured rates as high as 16.0%. Offering sliding scale premiums and enhanced subsidies can make insurance more accessible for low-income populations.

Dynamics 365’s financial tools can manage income-based plans by integrating with external income verification systems to automatically gather income data. The platform uses this data to calculate sliding scale premiums based on predefined criteria. It then automatically applies these adjusted premiums to the member’s account, ensuring that low-income individuals are charged affordable rates.

Improving Health Insurance Satisfaction

Customer Experience: With 85% of Americans reporting satisfaction with their health insurance plans, maintaining high levels of customer service is crucial.

Dynamics 365’s integrated customer service platform can improve response times, track service issues, and personalize interactions, enhancing overall customer satisfaction.

Conclusion

Navigating financial pressures, regulatory changes, and evolving member needs are significant challenges for healthcare payors in the upcoming years. Dynamics 365 for Insurance can help by streamlining operations, automating workflows, and enhancing member experiences. By unifying data and leveraging advanced analytics, payors can improve efficiency and compliance.

Ready to transform your healthcare insurance operations?

Contact Nalashaa Digital today to see how Dynamics 365 can make your organization more efficient and member-focused.

Recent Posts

AI in Dynamics 365 CE [Where It Actually Saves Money and How to Use It]

Feb 25, 2026

Business Central On-Premises to Online Migration [A Complete Guide]

Feb 20, 2026

15+ Years In [From Dynamics 365 Expertise to Enterprise Solutions Delivery]

Jan 20, 2026

Category

Our Expertise

About Author

Aiswarya Madhu

Aiswarya Madhu is an experienced content writer with extensive expertise in Microsoft Dynamics 365 and related Microsoft technologies. With over four years of experience in the technology domain, she has developed a deep understanding of Dynamics 365 applications, licensing, integrations, and their role in driving digital transformation for organizations across industries.

Never Miss News

Want to implement Dynamics 365?

We have plans which will meet your needs, and if not we can tweak them around a bit too!